Buy Now Pay Later (BNPL) schemes have become increasingly popular over the years. In fact, 42% of UK adults have used BNPL services at some point in their lives. That's nearly half the adult population.

Customers are already using these services for many businesses, as they’ve become not just a nice-to-have, but an expectation for many shoppers. That means if you're not offering BNPL options at your checkout, customers might just bounce to a competitor who does. But for every benefit comes something key to consider, meaning you’ll need to evaluate carefully whether you want to use BNLP schemes for your online shop.

To help, we’ve broken down the ins and outs of BNPL options and, importantly, whether it makes sense for your business.

The current economic climate has created the perfect storm to use BNPL across the UK. With inflation affecting household budgets and the cost of living continuing to rise, many are increasingly looking for ways to manage their cash flow more effectively. When your energy bill's gone up 40% and your weekly shop costs more than your old monthly budget, suddenly spreading a £200 purchase over four payments feels less like luxury and more like necessity. It’s because of this that many shoppers are turning to flexible payment solutions that allow them to spread costs over a longer period.

Recent research from the Financial Conduct Authority shows that BNPL usage has grown hugely, with over 15 million UK adults having used these services. It almost comes as no surprise those between 18-34 have the largest slice of the BNPL pie, but we’re also seeing significant growth in older demographics who might have been previously hesitant to use these newer payment plans.

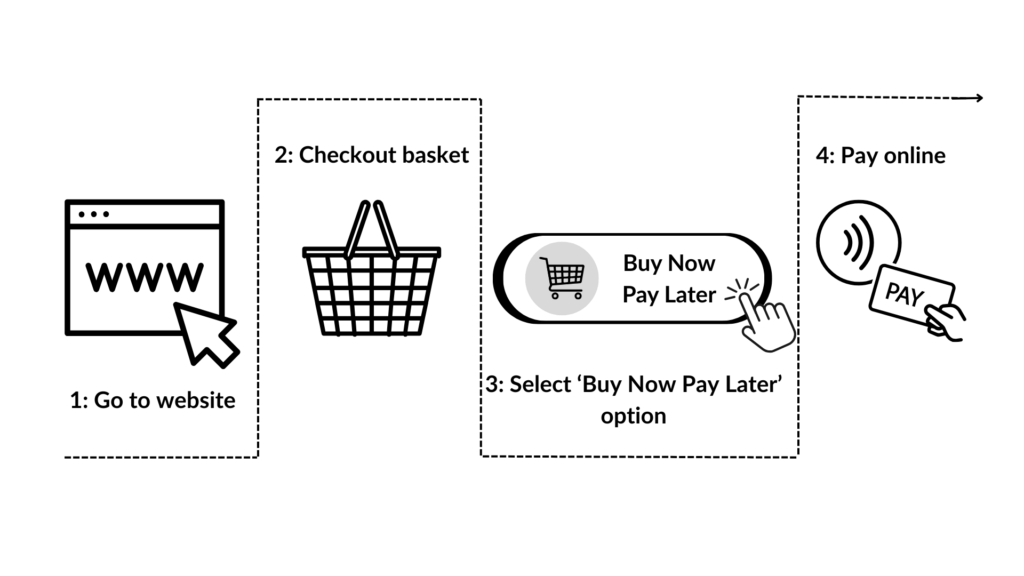

Let’s not forget that the COVID pandemic fast-tracked the BNPL trend, too. Online shopping became standard for people who'd seldom bought anything online, helping them become more at ease with digital payment solutions. Once you're comfortable clicking "buy now" on a website, switching from your debit card to "pay in 3" isn't a huge leap. Suddenly, a £200 purchase can be spread out to four manageable payments of £50, making higher-value items more accessible to customers who might otherwise hesitate at the checkout.

The bottom line is that BNPL removes the immediate financial pain of a large purchase, reducing checkout abandonment rates. What’s more, data from various BNPL providers indicates that customers are making larger purchases when flexible payment options are available. The implication is that when customers see that they can pay for an item over time, their mindset shifts from "Can I afford this?" to "This is manageable."

Let's be honest - the BNPL space is pretty crowded, and they're all fighting for the same customers. But they're not all the same, and choosing the wrong one can be expensive.

Klarna still owns the mindshare. Everyone knows that pink logo. They've got multiple options - Pay in 3, Pay in 30 days, and longer financing. The approval process is smooth, and let's face it, having Klarna at checkout does add a certain legitimacy to your store. But here's the catch - everyone's using Klarna, so you're not exactly standing out.

PayPal Pay in 4 is interesting because so many people already have PayPal accounts. The trust factor is massive, and integration is usually straightforward if you're already using PayPal. The fees aren't terrible, and the checkout experience is seamless. It's not flashy, but it works.

Clearpay has been smart about targeting fashion and lifestyle brands. They've invested heavily in making their brand feel premium, and their demographic skews younger and more fashion-conscious. If you're selling to Gen Z, Clearpay might be your best bet.

Then there's Laybuy, which works well for higher-value items, and Zilch, which has a more flexible approach to payment scheduling. The choice really depends on your customers and your average order value.

It’s also worth considering that different BNPL providers have different approval rates. Some are more generous with credit decisions; others are stricter. That can directly impact your conversion rates, so it's worth testing if you're serious about optimising.

Everyone talks about customer BNPL, but business customers need payment flexibility too. In fact, they might need it even more, as business purchases are usually larger and cash flow is even more critical.

B2B finance solutions, like those from iowca and Novuna, are becoming more sophisticated. They can handle everything from small purchases to major equipment investments, and the approval process, while more complex than consumer BNPL, has gotten much smoother.

However, B2B customers are always making considered purchases. They're not impulse buying. If you can remove the friction of lengthy procurement processes and offer instant payment terms, you can significantly speed up their buying decisions.

Business customers also tend to have higher lifetime values, so even if the integration is more complex and the fees are higher, the return on investment can be substantial.

However, there are also several things to keep in mind when it comes to B2B Buy Now Pay Later schemes. For starters, the approval process for B2B finance is more complex than customer-based BNPL, often requiring business verification, credit checks, and sometimes personal guarantees.

B2B finance solutions also often come with different fee structures and requirements compared to consumer BNPL. The integration process may be more complex, and you'll need to consider how these solutions work with your existing business customer processes and credit policies.

Buy Now Pay Later solutions need careful consideration, but there’s no denying the opportunities they present. So, let's talk numbers. Most retailers see conversion rate improvements of 20-30% after implementing BNPL. But are these genuinely new sales, or are people just switching payment methods?

This is where it gets tricky. If customers are just using BNPL instead of their credit card, you're paying higher fees for the same revenue. The real value comes from customers who wouldn't have bought at all without the flexible payment option.

The numbers don’t lie for retailers who have adopted BNPL schemes, though. eCommerce businesses with BNPL solutions are seeing conversion rate improvements of 20-30%, with some sectors experiencing even more. Average order values also tend to increase when BNPL options are available. The psychological impact is that when people can pay over time, they're more likely to add extra items or upgrade to premium options. But you need to monitor this carefully. Higher order values are only valuable if they translate to higher profits after fees.

The fees are the elephant in the room. BNPL transaction fees are typically 2-5% (sometimes more), compared to 1-3% for card payments. That might not sound like much, but on thin margins, it adds up quickly.

There's also the risk side. While BNPL providers handle the credit risk, you might see changes in chargeback rates or customer dispute patterns. Some providers have different policies for refunds and returns, which can complicate your operations.

What isn’t talked about enough are BNPL’s regulations. These are currently in place to protect users from unaffordable money borrowing, but tighter BNPL regulations are set to be put in place from 2026 at the earliest. This is following reforms to the Consumer Credit Act and will be enforced by the Financial Conduct Authority (FCA).

What does this mean for merchants? Probably higher compliance costs passed through as higher fees and likely restrictions on how BNPL can be marketed to consumers. However, for consumers, the updated regulations will bring better clarity on BNPL models, affordability checks to prevent the accumulation of unaffordable debt, and more.

It’s worth keeping in mind that the regulation isn’t a bad thing by any means, as it means the creation of more standardised, predictable relationships between providers, merchants, and customers. So, keep your eyes peeled for any updates on these regulations and when they are set to arrive.

The decision to use Buy Now Pay Later options isn't just about following market trends, it's about understanding your customers' needs and if you can support these payment methods effectively.

If you’re selling higher-ticket products or have higher average order values, then providing a BNPL option makes sense. The conversion lift and increased order values will likely offset the higher fees.

If you're selling essential items or low-value products, or if your customers are generally not price-sensitive, the impact might be minimal and the fees could hurt your profitability.

The integration side is usually straightforward, but don't underestimate the operational impact. You'll need to update your customer service processes, potentially adjust your refund policies, and definitely monitor your metrics more closely.

Importantly, BNPL should be part of a broader payment strategy rather than a standalone solution. That means don’t just implement it because everyone else is. Do it because it solves a real problem for your customers and creates genuine value for your business. If it does both of those things, the fees become an investment rather than a cost.

As for which provider to start with? Start with just one, perhaps Klarna or PayPal Pay in 4, then test it fully. Monitor not just conversion rates, but customer lifetime value, return rates, and overall profitability. This data will help you optimise your approach and determine whether BNPL is delivering genuine value for your business.